Market Observations: Q1 2021

It was another positive quarter for risk assets around the globe, with investor sentiment supported by progress in vaccine rollouts across many large countries, signs of acceleration in economic growth, and promises of more US government spending in the form of a proposed US$2.25 trillion, eight-year infrastructure spending program by the Biden administration, which would have a positive impact on global growth. However, gains and sentiment were tempered by the continued spread of the Coronavirus and its variants, and their subsequent impact on growth. Another dampener was growing market concerns over higher US inflation and interest rates which led to bond weakness, mainly in the US. However, South African equities outperformed most other emerging and developed markets, recording strong gains for the quarter, coming off low valuations compared to other markets and helped by their Resources exposure.

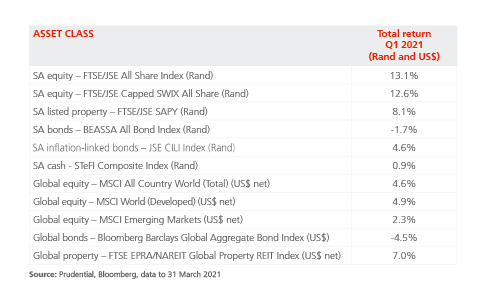

As shown in the table, in US$ terms, global equities (the MSCI All Country World Index) returned 4.6% for the quarter, with emerging markets lagging developed markets at 2.3% and 4.9%, respectively. For SA investors, the rand’s marginal 0.8% depreciation against a broadly weaker US dollar would have slightly helped investment returns. Global bonds delivered -4.5% for the quarter, hit by rising longer-dated US Treasury yields. And finally, global property posted good gains with a 7.0% return. As in the previous quarter, central banks kept interest rates broadly unchanged at very low, accommodative levels – seemingly less concerned about inflation than investors – and governments continued to enact fiscal support packages for consumers and businesses.

In the US, consumers started receiving stimulus checks from the government amid a much faster-than-expected vaccination programme rollout that encouraged a more positive outlook among consumers and investors. This was further boosted by the potential of a huge infrastructure spending programme that would add another US$2.25 trillion to the economy over the next eight years.

At its 17 March policy meeting, the US Federal Reserve (Fed) left interest rates unchanged, even as it revised its GDP growth forecast for 2021 sharply higher to 6.5% from 4.2% in the previous quarter. Chairman Jerome Powell indicated that despite rising US Treasury (UST) yields, and a rise in February CPI to 1.7% y/y from 1.5% in January, the central bank was not worried about inflation and would likely keep rates on hold through 2023. This was because they estimate it would take some three years for inflation to return to within the Fed’s target range, and because they would tolerate inflation rising above its 2% target for a period of time before raising rates.

Meanwhile, the yield on the 10-year US Treasury bond rose to over 1.7% during the quarter, reaching a one-year high as the yield curve continued to steepen to reflect investors’ inflation worries. The difference between the 2-year and 10-year UST yields rose to around 2.3%, its highest level since 2014. However, other developed countries’ bonds did not follow suit, with only Canada seeing a small rise, due to their much weaker recoveries.

US equity markets continued to perform well despite their more expensive valuations, as the S&P 500 returned 6.2% for the quarter, the Dow Jones Industrial 30 delivered 8.3%, and the technology-heavy Nasdaq 100 produced 1.8% (all in US$).

In the UK, the mood was buoyed by the exceptionally fast implementation of the country’s vaccination programme, which lifted hopes of accelerated growth to come. The government unveiled plans to lift all pandemic restrictions by 21 June, should all things go to plan. Better-than-expected Q4 2020 GDP figures also helped lift sentiment, with the UK economy expanding by 1.0% q/q. At the same time, the Bank of England left its key interest rate unchanged as expected, however reiterated that it would ease monetary policy if needed. February consumer inflation was very subdued at only 0.4% y/y, down from 0.7% the previous month and reflecting the strict lockdown conditions in place over much of the period.

In the EU, the European Commission lowered its GDP forecasts for 2021 from 4.2% to 3.8%, stating that the resurgence of Covid-19 infections and the appearance of more contagious variants had forced many countries to reintroduce lockdown measures. Among the bloc's largest economies, Spain and France are expected to expand at the steepest rates for 2021, with GDP growth forecast at 5.6% and 5.5% respectively. The risks surrounding the Eurozone growth outlook remained tilted to the downside, but became less pronounced due to prospects of a global economic recovery and the launch of vaccination campaigns. Sentiment, however, remained under pressure due to the slow pace at which vaccinations have been rolled out and the impact this would have on the Eurozone’s economic recovery. Eurozone GDP shrank by 0.6% q/q in Q4 2020.

Meanwhile, the European Central Bank (ECB) left interest rates on hold at its 11 March policy meeting, emphasizing it would continue its bond purchases and other supportive monetary measures until inflation reached its 2.0% target. Consumer inflation in the Euro area remained steady at 0.9% y/y in February, indicating very little cost pressure in the region.

For the quarter, UK equities outperformed their regional counterparts, helped by the better valuations on offer and its better vaccinations progress. The UK’s FTSE 100 returned 5.9%, the German DAX 4.5% and France’s CAC 40 5.3% (in US$).

Meanwhile, in Japan the economy advanced at a strong 3.0% q/q pace in Q4 2020, beating market estimates of a 2.3% expansion. For the year 2020, the economy shrank 4.8%, marking the first contraction since 2009. The Bank of Japan left its key short-term interest rate unchanged at -0.1% and maintained the target for the 10-year Japanese government bond yield at around 0%. The central bank also upped its GDP growth projection for the next fiscal year to 3.9% from 3.6%, while the forecast for the current fiscal year shifted marginally from -5.6% to -5.5%. Deflation persisted as consumer prices declined 0.4% y/y in February, however there was a slowdown in the pace of the drop as energy prices rose.

In China, the government’s crackdown on large tech companies like Tencent towards the end of the quarter created investor worries of further curbs and tighter regulation to come on other companies, weighing heavily on the local equity market, while Hong Kong equities fared better despite the introduction of further measures to curb democracy in the special administrative region.

News that the People’s Bank of China (PBoC) would continue to provide economic support in 2021 helped to counterbalance the negative sentiment, along with reports that it would refrain from sudden shifts in order to provide stability. The PBoC left its benchmark interest rates steady at its February policy meeting, as consumer inflation (deflation) for February was reported at -0.2% y/y and producer inflation came in at 1.7% y/y as months of strong manufacturing growth pushed the costs of raw material higher. In fact, positive data saw non-manufacturing and services PMI both bouncing back sharply in March to 56.3 (from 51.4) and 54.3 (from 51.5) respectively.

For the first quarter of 2021, Japan’s Nikkei 225 was flat, delivering 0.0%, the MSCI China returned -0.4% and Hong Kong’s Hang Seng produced 4.3% (in US$).

Among other large emerging equity markets, in US$ terms the MSCI South Africa was by far the top performer for the three months with a 12.3% return, followed by the MSCI India with 5.2% and MSCI Russia with 5.0%. South Korea’s KOSPI recorded a 2.3% return, but Brazil’s Bovespa lost 9.8% on the back of the uncontrolled spread of the Coronavirus there, and the MSCI Turkey had a disastrous quarter with a -20.2% return following the President’s dismissal of the central bank governor and most of his top cabinet officials, among other measures.

After gaining over 26% in the last quarter of 2020, the spot price of Brent crude oil closed 22.7% higher in Q1 2021 at around US$60 per barrel, propelled higher by expectations of a quicker and stronger recovery in global growth and curbs on supply. The gold price lost ground as risk-aversion continued to abate, down 11% for the quarter. However, most other commodities were stronger, as platinum and palladium rose 8.2% and 9.4%, respectively, while copper was up 14.3% and aluminium 11.9% higher.

South Africa

In South Africa, market sentiment was supported by the government securing a supply of vaccines and kicking off phase one of its three-phase vaccination campaign on 17 February, with the aim of vaccinating roughly 67% of the population by the end of the year. Later in the quarter, investors welcomed the news that local manufacturing of the Johnson & Johnson’s Covid-19 vaccine had commenced, with 30 million doses earmarked for use in South Africa. However, questions remained over insufficient supply and the slow pace of the rollout, as well as the impact it could still have on growth.

Also helping the improving environment was news that the South African economy grew by an annualised 6.3% q/q in Q4 2020, beating market expectations of a 5% increase, with eight out of 10 industries reporting positive growth in the fourth quarter. As widely expected, the South African Reserve Bank (SARB) left the repo rate unchanged at 3.5% during its 25 March meeting, while also lowering its economic growth forecast for Q1 2021 to -0.2% from 1%. However, it lifted its projected total 2021 GDP growth to 3.8% from 3.5% previously due largely to accelerating global growth prospects. It also moved forward its projected rising interest rate path slightly, pencilling in 25bp rate hikes in each of the second and fourth quarters of the year, compared to the third and fourth quarters previously. Despite this, Governor Lesetja Kganyago stressed that the pace of the country’s economic recovery would largely depend on the government’s ability to effectively roll out its vaccine programme and mitigate the onset of a third wave of infections.

Finance Minister Tito Mboweni unveiled a better-than-expected national budget in February, which saw the scrapping of proposed personal tax increases in favour of fiscal consolidation and reined-in expenditure to support the pandemic-battered economy. Mboweni proposed a government wage bill cut to help reduce government debt, and to aid in the funding of the free nationwide vaccine programme. Other highlights included the lowering of the corporate income tax rate to 27% as of 1 April 2022, the first reduction since 2008, while the excise duties on alcohol and tobacco products were raised by 8%. Investors, however, remained cautious over the path of recovery outlined by Mboweni, with Moody’s stating that the lower budget deficits were unlikely to prevent debt from rising. Fitch said the country still faced "severe challenges" to implement fiscal consolidation.

In other positive news, inflation remained subdued, with headline CPI slowing to 2.9% in February, below the SARB’s 3%-6% target range and below market expectations. Also, the government unveiled plans for eight independent power producers to support the nation’s struggling power utility, which will consist of solar energy, wind, liquefied natural gas and battery storage, with renewable energy expected to start adding to the grid from August 2022. The project is expected to inject R45bn of private investments into the economy. Meanwhile, the South African National Treasury published its updated ‘Operation Vulindlela’ plan, detailing the government’s strategy to boost the economy in the wake of the Covid-19 pandemic.

The FTSE/JSE All Bond Index (ALBI) was in the red for the quarter with a -1.7% return as foreign investor demand spluttered. The yield curve continued to flatten as bonds in the 1-3 year maturities sold off more than longer-dated bonds. SA inflation-linked bonds posted another strong performance, delivering 4.6% after 5.4% in the previous quarter as investors sought some inflation protection, and cash (as measured by the STeFI Composite) produced 0.9% for the three-month period.

The FTSE/JSE All Share Index delivered an impressive 13.1% return in rand terms for Q1 2021, benefitting from higher commodity prices and the stronger global and local growth outlooks, as well as re-rating. Gains were led by a strong performance from Resources shares (J258 Index) at 18.7%, while Industrials (J257 Index) delivered 13.0%. More locally-focused sectors were not as impressive but still in the black, with Property (All Property Index) posting an 8.1% return and Financials (J580 Index) producing 3.8%.

Finally, the rand put in a mixed performance against the three major global currencies during the quarter, in an environment which saw general US dollar weakness. The local currency lost 0.8% against the US dollar and 1.8% versus the pound sterling, but was up 3.5% against the euro.

How have our views and portfolio positioning changed?

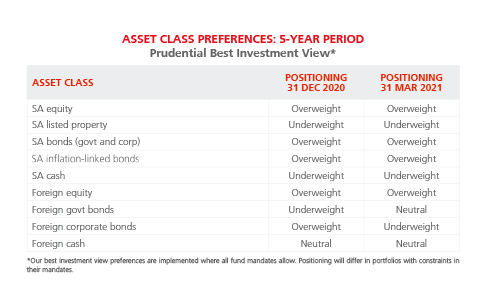

Starting with our view on offshore asset allocation, we made some small changes to our positioning during the quarter in order to take profits, reduce some portfolio risk and still take advantage of valuation opportunities. However, we remained slightly overweight global equities versus global bonds, global property and cash. Within our global equity positioning, as US equities were expensive compared to other markets during the quarter, our portfolios continued to be underweight the US market in favour of selected European and emerging market equities. We have been aiming to position the portfolios with higher weightings of very high-returning global assets while maintaining a mix of assets that have diversified return profiles.

During the quarter we took advantage of the strong global equity market recovery and took some profit on our overweight equity position, but remained slightly overweight. At the same time, we also shifted to a neutral weighting from underweight global government bonds, adding select exposure, with emerging market government bonds having been particularly attractive. We also opportunistically took profit on our investment grade corporate credit holdings as spreads narrowed, ending the quarter underweight in this asset class. This overall positioning would benefit portfolio returns in the event of a sell-off in risk assets, as fixed interest assets would gain ground.

Our best investment view portfolios continue to be overweight SA equities. SA equity valuations (as measured by the trailing Price/Book value ratio of the FTSE/JSE Capped SWIX Index) were trading at around 1.7X at the end of March, up from around 1.6X at the beginning of the quarter, but still attractive compared to the market’s long-term P/B average of around 2.1X. This positioning contributed strongly to both absolute returns and relative alpha in our best view client portfolios for the quarter. Forward earnings yield upgrades have started to come through in the local market, especially for Resources companies, and to a lesser extent for Industrials. Even SA bank forward earnings have experienced upgrades, although to a smaller degree.

Within SA equities our stock picking has led to above-market performance in our best investment view portfolios for the quarter thanks to contributions from Resources groups like Anglo American, Implats, Sasol and Sappi. We also continue to prefer large companies that offer sound, high-quality diversification such as Naspers, British American Tobacco, Remgro and MTN. We have also maintained our overweight in the local banking sector, with exposures to Absa, Standard Bank and Investec given the attractive valuations they offer. Banking stocks continued to recover over the quarter as the outlook for the economy and consumer financial health improved.

We have kept our substantially underweight positioning in SA listed property in Q1 2021. This positioning reflects the ongoing uncertainty surrounding the outlook for the SA economy and property company distributions, as well as the relatively high debt levels in the sector. The risks around property company earnings remain high, and as such we have ensured that we are holding high-quality companies with strong balance sheets within our small exposure to the sector, like Growthpoint.

During the quarter we maintained our overweight in SA nominal bonds, and added around 1% in exposure to our holdings as yields rose in March. Our best investment view portfolios continue to be tilted towards longer-dated maturities. Although bonds recorded losses over the quarter, the flattening of the yield curve favoured our positioning and helped to cushion losses. As of 31 March, 10-year government bond yields were even more elevated compared to their history, offering around 9.6% versus 9.1% at the start of the quarter, and equating to an after-inflation (real) yield of around 4.6% (assuming inflation of 5.0% over the next decade). This is substantially above our long-run fair value assumption of a 2.5% real yield. We believe these yields will more than compensate investors for the risks associated with the government’s precarious fiscal position and possible further credit rating downgrades.

We kept our overweight exposure to inflation-linked bonds (ILBs) during the quarter, and our client portfolios benefited from this positioning given these assets’ significant outperformance versus nominal bonds (nearly 5 percentage points) over the period. The gap between ILB and cash real yields continues to be wide, with real yields on cash currently negative. ILB real yieldsre also attractive compared to their own history and our long-run fair value assumption of 2.25%.

Lastly, our best investment view portfolios remain underweight SA cash, since prospective real returns from this asset class are negative and other SA assets relatively more attractive.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter