Lessons for limiting your capital downside

When evaluating the success of their unit trust investments many investors focus on how fast their portfolio has grown. But capital appreciation is only the second most important rule of investing: capital preservation is the first.

This is because recovering from a loss is much harder than investors realise. Not only does it take time, but it also takes a much greater return in order to regain that lost ground. For example, a 10% loss requires an 11.1% gain to break even; a 50% loss requires a 100% gain to break even and a loss of 70% requires a 233% gain to break even. This shows the importance of managing the downside, as well as generating upside in a portfolio, especially in uncertain times like the present. And two of the very best ways to limit losses? Diversification and holding riskier assets for longer.

If capital preservation is your sole objective, it would make sense to invest only in fixed income investments such as cash or bonds. However, most investors need both capital protection and capital appreciation -- the latter greater than what can be achieved with fixed income funds.

Getting capital protection and appreciation

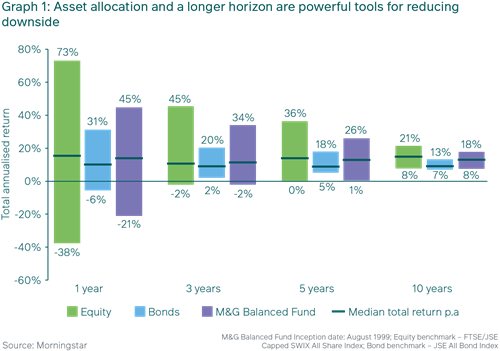

How to achieve both? The answer, of course, is through strong diversification and a longer-term investment time horizon as offered by a balanced or multi-asset fund such as the M&G Balanced Fund. Its range of returns is represented by the purple bars in Graph 1. As you can see, the Fund has experienced less downside than equities (the green bars), while also outperforming bonds (the blue bars), over every period through 10 years. In addition, after holding the Fund for five years, the losses over the one-year period have been completely eliminated and the volatility of returns in the Fund has been significantly reduced.

The graph clearly demonstrates the fact that the risk of losing money in equities falls over time, so equities should be viewed as a medium- to long-term investment. When held for five years, in our view, balanced funds are an excellent way of making the most of the ups and limiting the downs of today’s market conditions.

Strong asset allocation

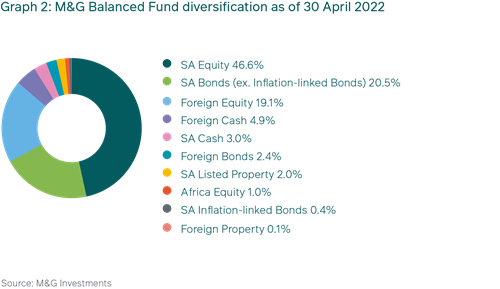

The mix of assets in a balanced fund is an important contributor to both capital protection and capital appreciation. Graph 2 demonstrates how currently, across both local and foreign markets, a total of 66.7% of the M&G Balanced Fund is invested in equities, 23.3% of the portfolio is invested in bonds, and 7.9% is invested in cash. There is also a small exposure of 2.1% to listed property.

The extent to which our managers hold certain asset classes is determined by the Fund’s investment mandates, but also by our long-held experience regarding the appropriate weights of each asset class necessary to achieve the Fund’s expected return outcome over time, while always considering changing market conditions and asset valuations.

Performance

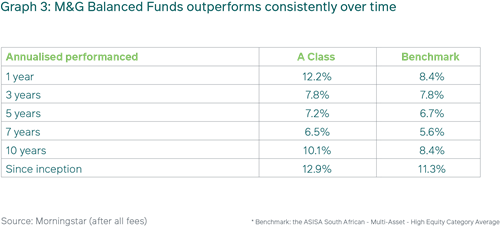

Looking at the Fund’s performance over various periods of its history in Graph 3, it has produced strong returns, consistently outperforming (and in one instance tying with) the average of its ASISA category, which is its benchmark. Of course it has done this through having recorded both higher gains and smaller losses, year after year, than the average of its peers.

Volatility set to continue

While Graph 1 above focuses on volatility going back over the past 10 years, going forward volatility will continue to plague global and local financial markets due to ongoing uncertainty around rising interest rates, inflation and growth in many of the world’s biggest markets. The ongoing Russian-Ukraine war, with its tragic losses and the higher inflationary pressures it brings, is also weighing heavily on market sentiment, with no end in sight.

This suggests that a well-diversified portfolio like a balanced fund may be a wise option to consider. The M&G Balanced Fund is designed to provide some downside cushion against volatility over the medium-term through the bonds and cash assets it holds, as well as the potential for inflation-beating returns through its exposure to risk assets it holds. In fact, we believe that, by their very nature, balanced funds should form the core of a long-term investment portfolio. You can find further details about the Fund in the latest Fund Fact Sheet.

For more information on investing with M&G Investments, please feel free to contact our Client Services Team on 0860 105 775 or email us at info@mandg.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter