Fairly valuing corporate bonds for our clients

This article was first published in the Quarter 3 2020 edition of Consider this. Click here to download the complete edition.

Key take-aways

- South African government bonds sold off sharply in March and April in the wake of the Coronavirus crisis and downgrades to the sovereign credit rating, reflecting the higher risk for investors holding the debt.

- In contrast, SA corporate bonds were much slower to weaken, with the prices of many issues barely changed two months into the crisis, and some only slightly lower, due largely to the illiquidity in the local market.

- Prudential chose to proactively mark down the prices of the corporate bond holdings in our portfolios to reflect this higher risk, in order to ensure our clients were able to buy and sell their unit trusts at fair prices and incur lower transaction costs.

- The impact of this was a weaker reported performance from some of our funds exposed to these bonds versus certain peer funds.

The last few months have seen incredible volatility across all markets and asset classes as the effects of the COVID-19 pandemic have reverberated across the globe. March saw a sharp sell-off in risk assets, while in April and May asset prices rebounded significantly.

One area of the local market which has experienced far less volatility is the listed corporate bond market, and more specifically corporate bond spreads (the additional compensation or interest rate investors earn for assuming the risk of default on these assets versus government bonds), which haven’t increased meaningfully. At first glance this appears somewhat counter-intuitive. It is difficult to argue that the pandemic and the steps taken to halt its spread have not negatively impacted most companies, and by implication the risk profile of their corporate debt. In this environment, one would have expected corporate bond spreads to have increased (rapidly and significantly), and prices to have fallen to reflect the greater risks involved. These would include, for example, increased liquidity pressure on these corporates, lower revenues and the higher likelihood of losses, business rescue or debt standstill.

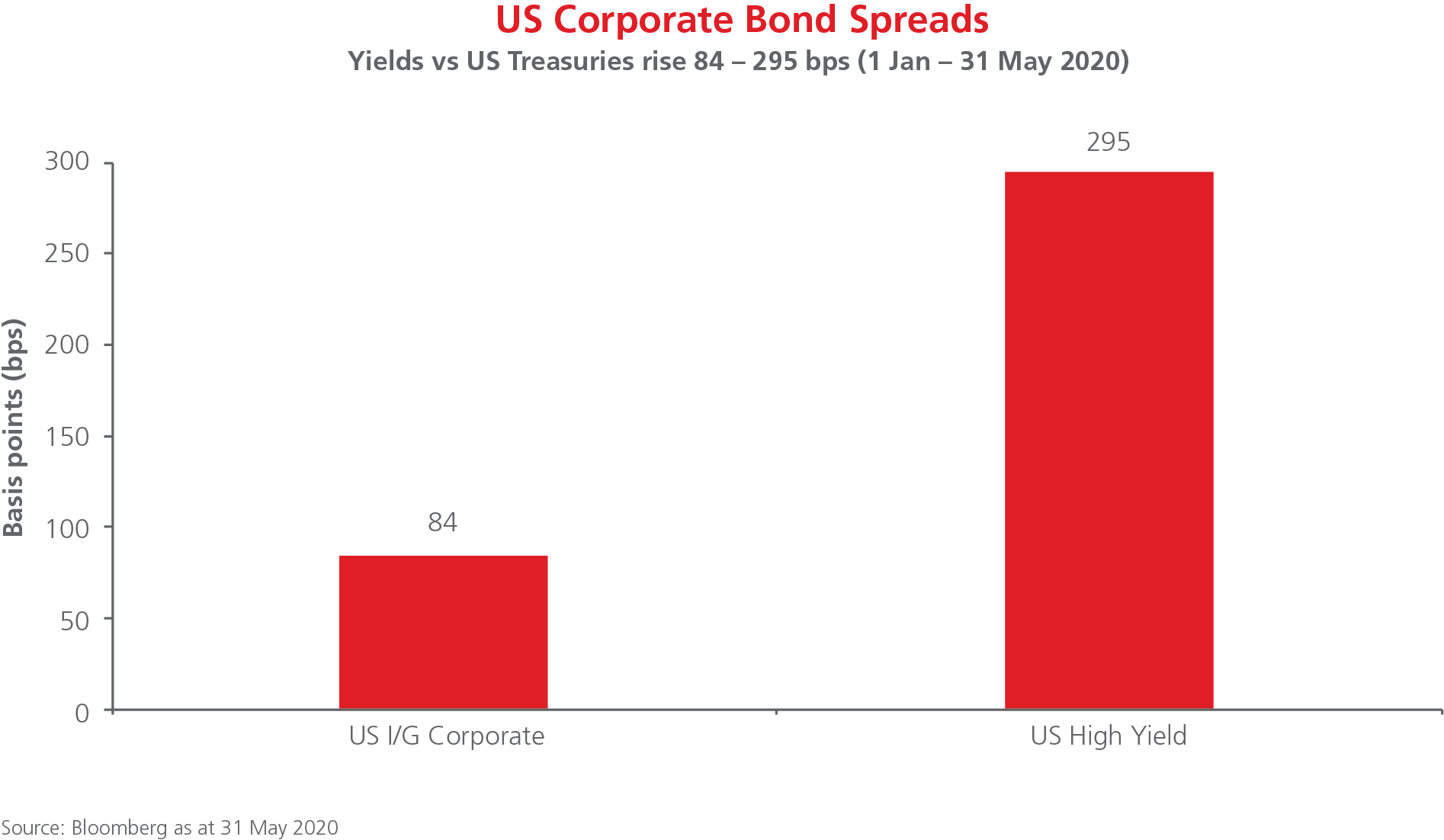

This is exactly what has happened in global corporate bond markets. The graph below shows that in the US, for example, investment-grade corporate bond spreads had weakened approximately 84 basis points (bps) or 0.84% for the year to 31 May 2020, while high-yield corporate bond spreads had risen some 295 bps (2.95%). Notably, these bond spreads spiked by much more than this at the height of the market panic in March, but subsequently retraced some of their losses. Yet the May levels still reflect substantially elevated risks compared to the beginning of the year.

SA corporate bond spreads see little movement

The reality in the South African corporate bond market is somewhat different. According to our analysis, as at 6 May 2020 a mere 19% of corporate bonds had seen their spreads widen since the start of the year, with the majority of bonds, or 70%, experiencing no change at all. By early June these numbers still had barely moved: roughly 22% had experienced some form of credit spread widening, while the vast majority, 67%, continued to see no change.

The extent of the spread widening is also instructive. Of those bonds where spreads had widened by early June, just over one-third had increased by 0.5% or more, far less than in the US.

Examining Land Bank debt

As most will probably be aware, the Land Bank defaulted on its debt payments over the course of the last few months. It is currently unable to pay interest or repay capital when due. Clearly the risks for the holders of its debt instruments have increased materially, but how has this been reflected in the pricing of its listed bonds in the market?

At the beginning of May, after the Land Bank’s announcements, the average price for its listed debt reflected at its full 100% (or par) value, i.e. with no impairment. By June more of its instruments had repriced, but still the average price remained close to par (around 97% of par). Given the lack of information and uncertainty surrounding Land Bank, it begs the question as to whether the pricing of its listed debt adequately reflects the challenges it faces. If one were to attempt to sell these instruments in the market, it would certainly not be possible to realise close to these prices. Consequently, Prudential chose to mark down the fair value of our Land Bank bond holdings significantly more than the market price, and we also stopped accruing any further income.

What has been happening?

The reality is that the local corporate bond market is far less liquid than its international counterparts. This is not a new phenomenon and is reflective of the nature of the participants (predominantly buy-to-hold investors), its relatively small size, and both the lack of supply and diversity of issuers. Liquidity has actually seen an improvement in recent years: increased issuance by corporates, new issuers as well as a growing number of participants have all helped to improve both liquidity and price discovery. The fact remains, though, that ours is not a liquid market, and in a rapidly changing risk environment, as we have been experiencing this year, corporate bond prices on the JSE are unlikely to adjust to reflect this reality in a timely fashion.

Why is this a problem?

Investors who hold corporate bonds include pension funds and unit trusts. Pooled investment funds like unit trusts are priced daily and provide daily liquidity to investors. This means that every day clients can invest or disinvest from a fund, and do so at the fund’s daily price, which is the net asset value (NAV) of the fund per unit. All the assets of a fund must be valued accurately every day in order to determine the fund’s total NAV. If the value of an asset in the fund (such as a corporate bond) is blatantly incorrect, it means clients would enter or exit the fund at an incorrect price, resulting in unfair treatment for them and other investors.

Another important aspect to consider is the asset management fees clients pay. Fees are charged as a percentage of a fund’s daily NAV, so if the price of an instrument used in the daily NAV is incorrect, it will mean that clients won’t pay the correct fees.

What has Prudential done?

While under normal circumstances it is not necessary to intervene, since market prices will accurately represent the fair value of assets held, in times of financial stress it is especially necessary to assess whether all assets we invest in are fairly valued. As part of our governance processes, we have a Fair Value Committee which aims to ensure that instruments held within Prudential portfolios are fairly valued. Importantly, this committee does not include any members of our investment team, in order to avoid any perception of bias.

Over the course of the last few months Prudential’s Fair Value Committee has chosen to adjust downward the fair value estimates of our corporate bond holdings in an attempt to more accurately reflect their heightened risks. This resulted in a reduction in the NAVs of our unit trusts holding these assets during March and April 2020.

It would certainly be easier to do nothing and wait for time to pass to see if market conditions improve, thereby avoiding the issue altogether. However, at Prudential we do not try to avoid difficult issues, but aim to be fair, transparent and treat all our clients consistently so that they buy or sell our unit trust funds at fair prices. Clients certainly shouldn’t be paying more for an asset than it’s worth. Equally, we would also want to avoid our clients having to pay inflated fees as a consequence of inflated, stale market prices of the corporate bonds in our funds.

Impact on Prudential funds

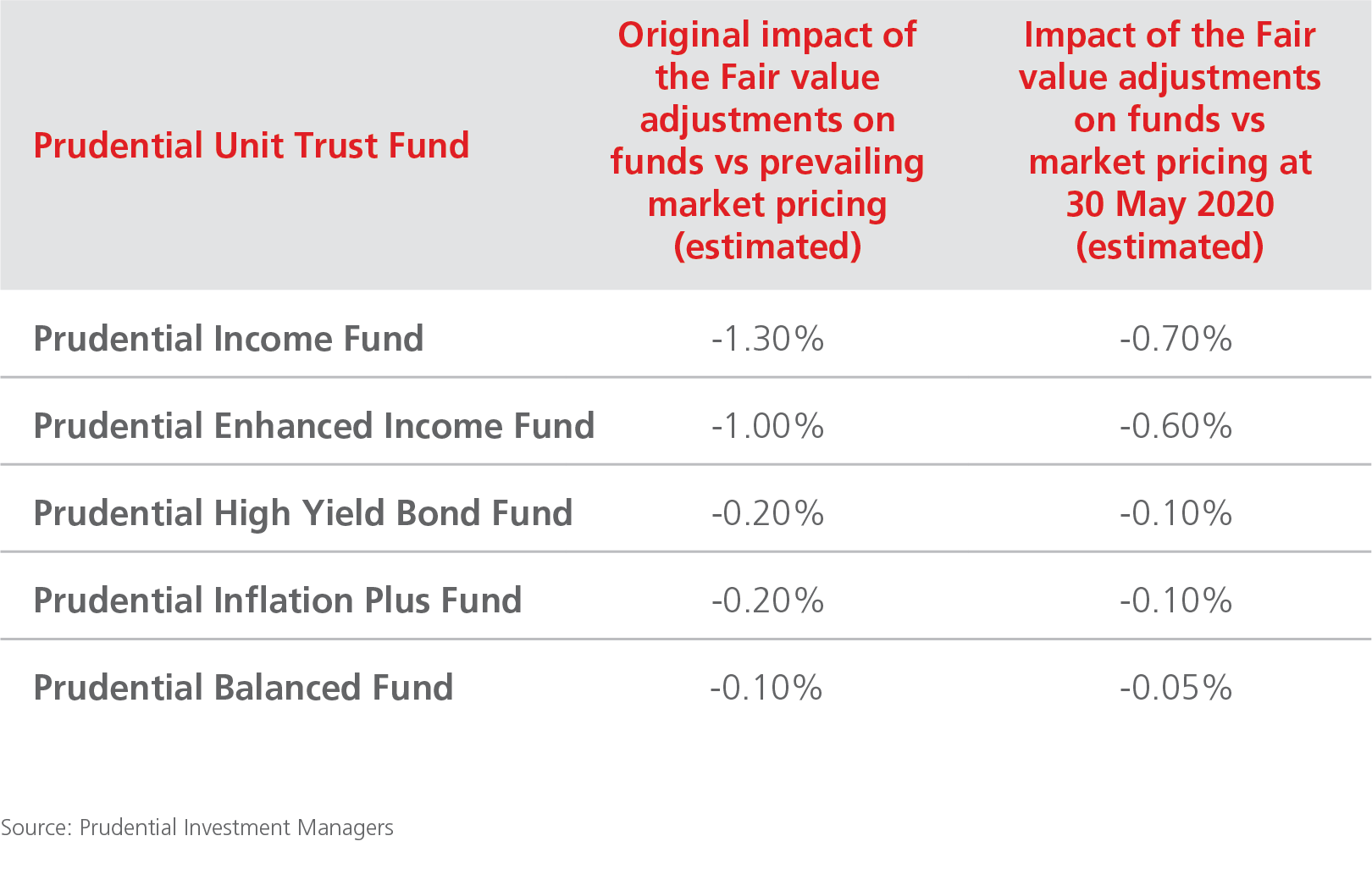

The following table shows the estimated impact on Prudential unit trusts’ returns to 30 May 2020. This includes our initial fair value adjustments at the time they were made compared to market pricing (shown in the first column) and the subsequent differential prevailing at the end of May. Note that this also includes the markdown following the Land Bank default. We can see that the differential narrowed over the period, as market prices adjusted and the impact of our own adjustments reduced.

We are continuously evaluating the pricing of the instruments within our portfolios to consider when it would be appropriate to revert to using market prices. This could be as a result of market pricing converging on our fair value assessments (as the table shows has already partly happened), or market conditions improving to such an extent that we feel our adjustments are no longer required in order to ensure fair treatment of all clients. In the case of Land Bank, for example, this would be when we receive any new and meaningful information to give updated guidance on the value of those instruments.

Treating clients fairly

We believe it’s important for our clients to understand the measures we take to protect their interests when it comes to valuing their funds – even if our actions are potentially detrimental to ourselves as investment managers.

In this case, our fund performance over this period may appear worse than that of some of our competitors’ funds, to the extent they may not have made similar-sized adjustments to the valuation of similar instruments.

We believe these steps were fair to our clients, and appropriate under the circumstances. As market risks reduce, we will remove these fair-value adjustments, and clients will then see a concomitant increase in portfolio performance.

For more information please contact our Client Services Team on 0860 105 77 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter