Certainly possible

This article was first published in the Quarter 2 2021 edition of Consider this. Click here to download the complete edition.

Key take-aways

- In an uncertain world, there exists the struggle of possibility against certainty. Human beings want both, but during times of stress we crave certainty above all else. This desire is hard-wired and causes us to reduce the world to over-simplified frameworks within which to make decisions. Recognising this shortcoming gives us the possibility to act with better understanding.

- Gauging how predictable some outcome might be, and determining that outcome, depends on the amount of information available about it and understanding the rules of the domain. There are very few areas or domains where we have 100% of the information and a clear understanding of the rules, and many where we have little of either.

- We can work to gather information and improve our understanding to help improve our outcomes. However, we experience diminishing returns to our efforts. Investment managers spend much time gathering information to improve their investment outcomes, working between the continuum of certainty versus possibility.

The novel Brick Lane by Monica Ali (adapted for the big screen in 2007) is both an enlightening and controversial fictional story about the trials, struggles and realisations of a woman mired in the vice grip of circumstance. The tale has many lessons to ponder, and for readers intrigued by a circumstantial life story wrapped in a love story, it’s well worth reading (or watching).

Although it now sits in the cobwebs of my memory, there was one theme that etched a more permanent impression in my mind; that is the dichotomy between possibility and certainty. I remember how well the concept was described by Chanu (husband of the protagonist) as he related the concept to his wife Nazneen during a somewhat heated exchange:

“Anything is possible when you are young. Then you get older and the thing about getting older is that you don’t need everything to be possible anymore, you just need some things to be certain.”

So what might be the parallels between a story about an immigrant woman in the East London borough of Shoreditch and matters of investing? It is the simple observation that from the most trivial domestic squabbles to the prognosis of a pandemic disease, there exists the struggle of possibility against certainty. Human beings crave both, but during times of stress, we crave certainty above all else. While this desire is hard-wired and has obviously served us well as a species, it is liability laden and coerces us into reducing the world to over-simplified frameworks. Therein lies the possibility to act with better understanding.

Determinism often sounds appealing

“An intellect which at a certain moment would know all forces that set nature in motion, and all positions of all items of which nature is composed, if this intellect were also vast enough to submit these data to analysis, it would embrace in a single formula the movements of the greatest bodies of the universe and those of the tiniest atom; for such an intellect nothing would be uncertain and the future just like the past would be present before its eyes.”

— Pierre Simon Laplace, A Philosophical Essay on Probabilities

“Une intelligence” was what Pierre Laplace called the analytical tool capable of knowing the future as well as we know the past. It is also often referred to as Laplace’s demon, which was and still is a noteworthy articulation of (causal) determinism. Determinism as a theory postulates that all events are completely determined by current or previously existing causes, i.e. for known inputs, there are known outputs. At first blush it is an alluring world view: phenomena have a known cause and are thus predictable. Besides having deeper implications for matters relating to morality, social justice and the scientific possibility of determinism1, very few domains of human existence satisfy the criteria of being perfectly predictable. And the few that do require significant computational resources to be deterministic.

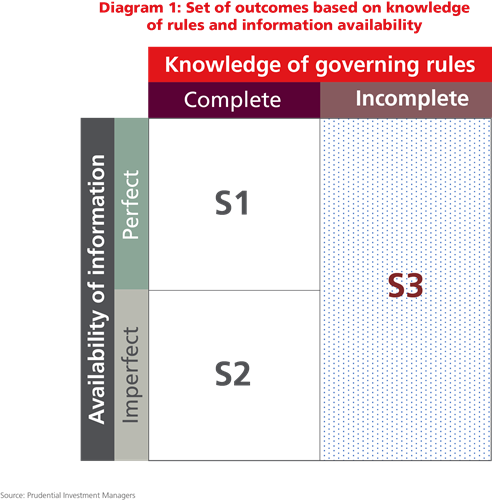

Since prediction is fundamentally a type of information-processing activity, we can estimate how predictable something might be based on the completeness of the information set and how effectively the information can be processed. More formally, a domain could be defined across two axes:

- Knowledge of the rules governing the domain;

- Completeness of information available for processing.

Diagram 1 depicts the range of combinations of these two variables.

The reader would have noticed that this intersection of two variables does not yield a quadratic workspace as would normally be the case for a 2x2 matrix. Rather, the setup follows a hierarchical construct on the logic that, if the rules governing a domain are not known, the completeness of an information set cannot be definitively ascertained (more on these open-ended domains later).

When stop signs are unambiguous

When the rules governing a domain are clear, it is likely we’re in a closed system with limited opportunity for ambiguity – stop signs always mean stop. Albeit computationally taxing, a good example of a problem that finds itself in a closed environment is chess. Chess falls into Segment 1 of the matrix (S1) since we have both complete knowledge of the rules governing the game and we have perfect information – there are a finite number of chess pieces on a clearly laid out board and they’re in plain sight. Although the game remains challenging for human beings (owing to our limited information-processing capabilities), with enough processing power outcomes are predictable. Winning at chess, and other domains that embed both perfect information and complete knowledge of the governing rules, becomes a matter of out-processing your opponent. These endeavours are almost exclusively skill based.

The second segment (S2) considers domains wherein we have complete knowledge of the rules governing the activity, but the information available for processing is incomplete or imperfect. Poker would be an example. While the rules are universally known to all players in a poker game, each individual player has a limited amount of information (some shared and some proprietary) with which to make predications. As the game unfolds – for example in a round of Texas Hold’em from the pocket cards to the flop, the turn and finally the river – more information is revealed about the potential hand, allowing players to better hone their predictions. Good poker players are not distinguished by their ability to predict which cards will come next – such superstition is reserved for economic forecasters. Neither is a grasp of the base odds a reliable skill; even an amateur player would have familiarised himself with the basic probability of each hand. The core skill among good poker players is ‘hand reading’: figuring out which cards your opponents might hold and how it might affect decisions throughout the hand. This makes poker a purely probabilistic endeavour. As more cards are revealed over the course of play, forecasts of which hand is playing out should become more precise. Nevertheless, it is generally not possible to predict exactly which hands your opponents hold until the cards are revealed.

To recap:

- We can evaluate problems based on how well we understand the rules governing a problem and the information with which to make assessments.

- When the rules are well known (we understand precisely how something works) and we have perfect information, problems can be solved precisely (given sufficient processing power).

- In domains where the rules are well known but we have incomplete or imperfect information, predictions should be made probabilistically.

- In these probabilistic domains, we cannot predict outcomes with certainty.

To have 100% of the answer, you need 100% of the information

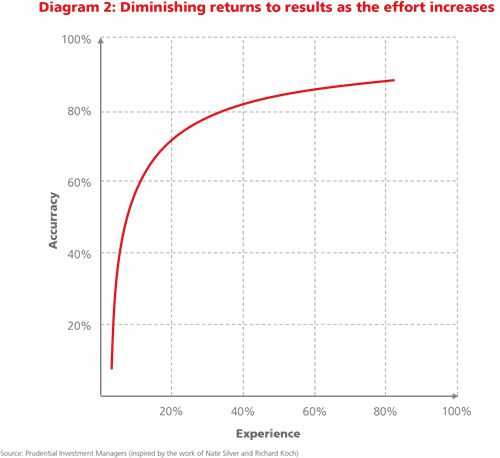

Activities that involve some type of prediction generally embed a learning curve. It stands to reason that the greater the effort exerted on the task, the more accurate the predictions. But this relationship is not linear. As Nate Silver details in his book The Signal and the Noise, learning curves are more likely to follow the Pareto principle or 80-20 rule, where progress is very encouraging as you begin, but rapidly tails off as efforts (or experience) increase. They demonstrate diminishing returns to effort.

This concave relationship between effort and accuracy, as depicted in Diagram 2, holds in many competitive endeavours where prediction is vital, including decisions related to investing. However, the vital point is not the absolute degree of accuracy one is able to muster, but the excess accuracy above the level set by the competition, that will determine a win from a loss. In a game of high stakes poker, all players arrive with a near-perfect knowledge of each hand and associated probability of victory, but winning the game requires much more nuance than simple knowledge of pot odds. It requires a reading of the unseen hand of the other players – information that is imperfect at best. Similarly, successfully beating the level set by the market requires outplaying other teams of motivated professionals trying to do the very same thing. Nuance, perspective and learning when to use exceptions are essential.

Afterthought: Stop signs are rare in the real world

Alas, much of the world we experience is not as clearly bounded or instructive as the stop sign you encounter when driving to your local grocery store. We do not live in the deterministic realm of chess, nor in a perfectly probabilistic one like that of a midnight poker den. The rules governing the functioning of the real world are less concrete and are subject to change, often without warning. This is squarely where investment decision-making lives.

The distinction between dynamic environments where the rules are subject to change (S3) and stable environments with imperfect information (S2) might appear to be an academic one. Granted, in practice the only concrete tools available to us are those used to confront matters where we have imperfect information in a stable environment, namely a probabilistic approach (we need to approach S3 environments as though they are S2 environments). But in the real world of dynamic randomness where decisions are made with incomplete information and the rules governing outcomes are themselves incomplete, we should incorporate the possibility that things could change in ways we are not familiar with. Failing to do so means we can approach with all the diligence of a World Series of Poker champion, but we may still get tripped up by a lack of imagination when the world changes. Alas, a panacea for alleviating a lack of imagination remains desperately absent.

Confronting uncertainty remains an impossibly challenging task, and despite Chanu’s cries to Nazneen for an enclave of certainty, we must contend more often with the uncertainty that accompanies possibility.

1There has recently been proposed a limit on the computational power of the universe, i.e. the ability of Laplace’s demon to process an infinite amount of information. The limit is based on the maximum entropy of the universe, the speed of light, and the minimum amount of time taken to move information across the Planck length, and the figure was shown to be about 10120 bits.[13] Accordingly, anything that requires more than this amount of data cannot be computed in the amount of time that has elapsed so far in the universe. Wikipedia

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter