Are you holding too much cash?

In today’s volatile market conditions, it may seem like the wise thing to do to hold more cash in your portfolio than you normally would, because of the safety it appears to offer. It is true that cash and near-cash investments like bank deposit accounts, certificates of deposit, money market funds and other short-term instruments are much less likely to lose value than equities, and their prices don’t move around as much since they aren’t listed on a market like the JSE. Yet if you are a longer-term investor, with a timeframe of more than five years, there are also significant risks involved in holding too much cash instead of equities: the likelihood that you are foregoing higher returns and their compounding effect over time.

Cash beating equities isn’t the norm

Over the last three years or so, cash has generally delivered more than equities in South Africa, which has tempted many investors to switch into cash and out of equities. ASISA statistics have confirmed this trend, as more investment flows have moved out of higher-equity funds and into more conservative, higher-cash solutions. Yet these returns are not the norm: South African equities consistently produce higher returns than cash the majority of the time, especially as time periods get longer.

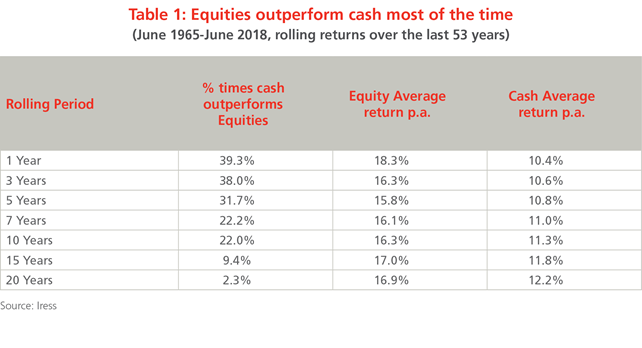

This is clearly shown in Table 1, where we have calculated the percentage of time that cash returns (as measured by the Short-Term Fixed Interest Call Index) have beaten equities (as measured by the FTSE/JSE All Share Index). You can see that when you look at any one-year (rolling) period during this 53-year timeframe, cash has outperformed equities only 39.3% of the time. And importantly, equities have returned an average of 18.3% p.a., while cash has returned only 10.4% p.a. As the time period gets longer, out to 10 and 15 years, the percentage of time that cash outperforms equities shrinks to only 22% of the time for all 10-year periods, and only 9.4% of the time for all 15-year periods. And over these 10- and 15-year periods, equities substantially outperform cash, by 5.0 percentage points and 5.2 percentage points respectively. This difference might seem small, but can make a significant difference: R1,000 invested over 15 years in cash at 11.8% p.a. and compounded will give you R5,329, while the same in equities at 17.0% p.a. will give you R10,539, or nearly double.

Equities will be volatile

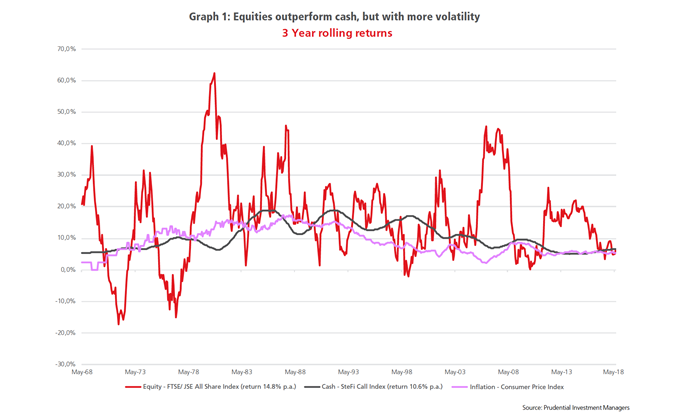

Meanwhile, if you look at how the returns of both cash and equities have actually been delivered, it is clear how much more volatile equities are than cash. Graph 1 shows both cash and equity returns over all three-year periods compared to South African inflation. The equity returns of the ALSI are represented by the red line, cash by the black line and consumer inflation (CPI) by the pink line. Over the 50 years to May 2018, equities experienced the largest and most frequent ups and downs, but they were also the highest-returning investments by far, delivering 14.8% p.a. compared to cash at 10.6% p.a. Cash returns only beat inflation by 1.5%.

Hold on to your equities

There’s no doubt that resisting the urge to build up cash in your portfolio is difficult during periods of poor equity returns, but successful investors will avoid moving to cash, and not attempt to time the ups and downs of equity cycles. Trying to time the market has widely been shown to result in inferior returns, because it is impossible to predict exactly when the cycle will turn. Many people end up selling low, missing the rally and buying high when they eventually do buy back equities – the best way to destroy value. But staying in the equity market means you will be buying low (if you reinvest your returns) and you won’t miss out on key rally days when you need to be exposed to the market as a longer-term investor. So when South African markets experience periods where equities slump and cash outperforms, remember that this is only temporary and that, eventually, equities will resume their stronger performance.

To invest in one of Prudential's award-winning equity funds, speak to your financial adviser or invest online now.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter