A Successful Balancing Act in 2017: The Prudential Balanced Fund

Prudent and timely active asset allocation decisions have helped the Prudential Balanced Fund produce strong returns and maintain its top-25% performance ranking in 2017 and over all annual periods over the past 10 years.

In a year of many unexpected twists and turns that have sometimes dramatically impacted South Africa’s financial markets, it may be reassuring for our clients to know that we have continued to apply our active valuation-based investment approach consistently, no matter what the news or conditions. The resulting strong performance of the Prudential Balanced Fund is a good example of how Prudential’s team of experienced portfolio managers has managed to successfully navigate 2017's difficult investment environment.

How do fund returns measure up?

To start with, let’s take a look at the actual comparative performance of the Prudential Balanced Fund, as shown in Table 1. For the 12 months to 31 December 2017, the fund returned 11.8% p.a., outperforming the 10.0% recorded by its benchmark, the average fund return in the ASISA Multi-Asset High Equity category, over the same period. According to Morningstar, this performance gave it a ranking of 42nd out of 173 funds in its category, within the top 25% (or top quartile) of its peers.

Of course, one year is an inappropriately short time frame when measuring fund performance. Table 1 provides a much longer performance history, highlighting that the fund has consistently outperformed its benchmark and ranked in the top 25% of its ASISA category peers for all annual periods from one to 10 years: for the 10-year period to 31 December 2017, it was 5th out of 45 peer funds. We believe such long-term consistency confirms that our investment approach does work when it comes to helping our clients achieve their investment goals.

Impatient investors missed out in 2017

The past year provided the perfect conditions in which to demonstrate why our investment approach of focusing on longer-term asset valuations, rather than trying to forecast the outcome of future events, has been consistently successful over time. Several key local events, the outcomes of which were very unpredictable, helped drive asset returns over the 12 months, as well as the global backdrop of very strong equity markets and accelerating growth. By year-end, most asset classes produced excellent total returns; however, these were delivered very unevenly over the 12 months.

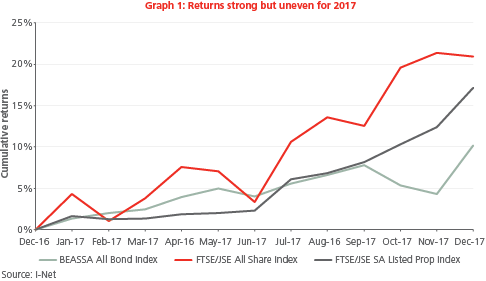

Graph 1 illustrates the very uneven returns investors experienced from South Africa's three major local asset classes in 2017. First, the red line depicts the strong 21% return from the FTSE/JSE All Share Index for the year: the cumulative return was below 5% until June, when equity returns finally started to accelerate. Consequently, impatient investors who had lost faith in South African equities after three years of very poor performance, and had reduced their equity exposure in favour of cash (a pattern confirmed in ASISA fund flow statistics in the second and third quarters of 2017) would not have benefited from the equity rally and its excellent returns.

Secondly, South African bonds (the BEASSA All Bond Index, ALBI) produced a surprisingly strong total return of 10.2% by the end of 2017, despite experiencing a rollercoaster ride between news of credit rating downgrades and government budget disappointments. The light grey line in Graph 1 illustrates how, for the 10 months to the end of October, the ALBI had returned only around 5.0%, not even keeping up with inflation. However, following the November decision by Moody's not to downgrade South Africa's local currency rating, and Cyril Ramaphosa's election as ANC President in December, bonds saw a sharp relief rally in the final two months and delivered over double that amount for the year.

Much like bonds, as an interest-rate sensitive asset listed property managed to give investors an excellent 17.2% total return in 2017. Yet the light grey line in Graph 1 shows how returns again came largely in the second half of the year, having recorded a return of less than 3.0% through May.

Given this sequence of returns for the year, investors who had lowered their exposure to interest rate-sensitive assets like bonds and listed property - as many asset managers did in attempting to forecast events - missed out (at least partly) on these asset classes' strong returns. The Prudential Balanced Fund (and other Prudential funds) did not miss out.

Maintaining appropriate valuation-based exposure

Why were our funds able to capture many of the available returns for the year? It was because we maintained appropriate exposure to South African equities, bonds and listed property based on our estimates of each asset class' longer-term valuation. We actively managed this positioning as valuations rose and fell during the year.

It was primarily the Prudential Balanced Fund's asset allocation, with its higher exposure to both bonds and listed property, that differentiated it from many of its peer funds in 2017, contributing to its top-quartile performance in its ASISA category. Individual stock selection was another element that contributed significant value. On the other hand, the fund's 25% maximum exposure to offshore assets (primarily equities) was common to many other peer portfolios throughout the year.

In our active asset allocation, for example, in December 2016 we added to our South African equity holdings by using some cash when valuation metrics moved below long-term fair value, and local equities also cheapened versus global equities. This gave us a high exposure heading into 2017 that we maintained to varying degrees during the year. Our analysis at the time pointed to the increasing likelihood of SA equity returns outperforming cash over the medium term, although it was impossible to know exactly when equities would start to deliver after three years of underperformance. Finally in July equity performance started to accelerate on the back of several factors, including: strong gains in stocks with offshore earnings like Naspers, British American Tobacco (BAT) and Richemont; continued rises in commodity prices which pushed shares like Anglo American and BHP Billiton higher; and a weaker rand. The fund had overweight holdings in all of the above global companies for the year, which contributed significantly to fund returns. Our overweight exposure to local financial stocks also paid off when they rallied in the final weeks of the year following the election of Cyril Ramaphosa as ANC President, amid perceptions of an improved outlook for the country in 2018.

For South African bonds, the Balanced Fund held a modestly high exposure early in the year, given that valuations were cheap relative to their long-term fair value in the aftermath of the country's credit rating downgrades. We believed that their high yields above 9% and 10% (for the 10-year and 20-year bonds, respectively) comfortably compensated investors for the risk involved. Within local bonds, we were also overweight longer-dated bonds versus shorter paper due to the more attractive yields on offer, while retaining an overweight exposure to corporate bonds.

We then bought more bonds when they sold off in June-July after the downgrades, and again following the poor Medium-Term Budget Policy Statement (MTBPS). At the same time, we trimmed exposure in mid-December when they rallied in the wake of the ANC elective conference.

Rewarding the patient investor

In hindsight, 2017 was a year in which patient investors were rewarded for having stuck with their disappointing SA equity holdings. Holders of SA bonds and listed property were also very generously compensated for braving the volatile interest rate market and ignoring the generally negative news environment driving it. Those who consistently focused on valuations, like Prudential, were likely to have come out well, as demonstrated by the performance of the Prudential Balanced Fund.

A look ahead to 2018

Going into the new year, a look at current valuations shows that most asset classes are trading within their long-term fair value range. None stand out as being particularly cheap or expensive. This, in turn, indicates that returns are likely to be near their average levels over the medium term. Consequently, investors should be fairly compensated for the risk involved in holding them. The collective asset valuations also indicate that the Prudential Balanced Fund is positioned to deliver double-digit returns over the medium- to longer term.

The fund remains at its maximum allowed exposure to offshore assets, providing valuable diversification and rand hedge benefits. It is also prudently but well exposed to South African equities, which retraced some of their earlier gains in December and now offer more value. At year end, the FTSE/JSE All Share Index was trading on a 12-month forward P/E ratio of around 15.4X, modestly expensive compared to its long-term fair value of around 14.5X. However, excluding Naspers (which is now over 20% of the local market and should be valued relative to global technology stocks), the overall market was still at fair value and priced to deliver attractive medium-term returns. The fund additionally has appropriate exposure to local bonds and listed property, the latter being priced to deliver double-digit returns over the medium-term.

While Prudential doesn't try to predict what 2018 will hold, we can safely say it will be another year of surprises. However, investors can rest assured that we will continue to stick to our proven investment process, month in and month out, no matter what the conditions, with the aim of always meeting and exceeding our client portfolios' risk and return objectives.

To invest in the Prudential Balanced Fund or to learn more about our multi-asset funds, contact our Client Services Team on 0860 105 775 or at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter