2020 - The year the world remained complex

This article was first published in the Quarter 1 2021 edition of Consider this. Click here to download the complete edition.

Key take-aways

- Despite the seriousness of the global pandemic, global equities (as proxied by the US S&P 500 Index) seemingly shrugged this threat off by trading below their 12-month levels for only 43 days.

- Many people thought this comprised irrational behaviour, but it actually reflected the complexity of global equity markets and the vast number of influences and actors that comprise them.

- The more accepting we are of market complexity, the better able we are to identify and optimise for those elements that are in our influence.

Do you remember your holiday season at the end of 2019? To many readers it will likely be recalled as a less troubling time. You probably walked into the festive cheer reminiscing about the monumental shifts that occurred during the past two decades since the humdrum of the Y2K bug, but nevertheless looking forward to the third. Promising possibilities lay ahead.

Now imagine you knew all the mayhem that would descend over the world in this, the 20th year since the turn of the millennium. Imagine you knew that a respiratory virus would cast a long shadow over the world, rising – as the sun does – in the east before sweeping westward over the globe. And then it made itself at home the world over. In addition to the healthcare crisis, imagine you had the insightful knowledge that the year 2020 would also be host to one of the deepest global economic recessions in living memory plunging millions of people into unemployment and reducing once-towering companies to pale shadows of their former selves. Given all the pain and suffering, distress and financial hardship, loneliness and emotional tumult, brought on by this microscopic virus, you would be forgiven for feeling somewhat less optimistic about the future. A touch of pessimism would not have been without cause.

If this narrative made you somewhat uneasy, I sympathise – writing it was equally unsettling. Despite the uneasiness, there is something surreal about the drama that is Covid-19 and its off-shoots. It is one of the few narratives universally understood and relatable to just about everybody reading this. Covid-19 is probably the first disease (in living memory) the world has suffered collectively in time. It is also likely the first time the phrase “we’re all in this together” has proved true on some level. Equally, Covid-19 was also the first time our species confronted a complex problem in real time.

Financial markets shrugged off the threat

The US bull market before Covid-19 was often scoffed at – I recall a commentator referring to it as “the most hated bull market of all time”. Many investors sounded alarm bells as they watched the market continue to rise into the news of Covid-19 all the way to the end of February 2020. Although the sell-off was probably accompanied by a fair amount of panic, when it finally cracked many investors sighed a breath of relief - the markets were finally behaving in a way that was sensible and congruent to the way we were feeling, as locked down citizens of the world. Market rationality prevailed.

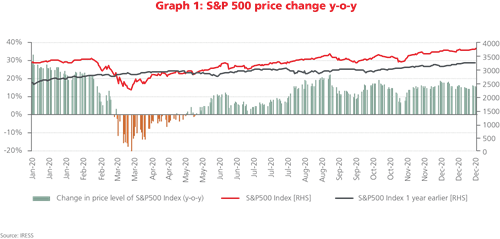

For the S&P 500, the correction lasted all of 43 trading days (see Graph 1 below). Perhaps the price action was rational, but the cries of many market pundits shouting in disbelief at the market’s irrationality still grows louder.

Graph 1 tracks the daily change in price of the S&P 500 relative to its price level a year ago. Over the calendar year 2020, the Index traded below its level from a year ago for only 43 days (or 16% of the time). This in a year when most people would probably agree with the narrative that the world is somewhat different and perhaps a little scary.

When something is widely relatable it seems only obvious

When a phenomenon is as widely relatable as our experience of Covid-19 has been it has the potential of framing our world view completely. We then expect all other phenomena we encounter to comply with this view, to live within this frame. The idea that financial markets shrug off the plainly obvious, albeit negative, reality we observe seems preposterous. It is not in the frame. We can only but conclude that the market and some market participants must be irrational and behaving in a way that is counter to reality. This may well be so. But consider the alternative: these comments might hint more at an underappreciation of the complexity of market mechanisms than they say about the rationality of the market.

When we observe real-world phenomena and attempt to translate them into market prices in a direct real-time (or linear) fashion, we fail to appreciate the emergent properties of a complex system. Or as the erudite mathematician and father of fractal geometry, Benoit Mandelbrot, explains, we should recognise there are indeed endogenous features within the market:

“Prices are not driven solely by real-world events, news, and people. When investors, speculators, industrialists, and bankers come together in a real marketplace, a special, new kind of dynamic emerges—greater than, and different from, the sum of the parts. To use the economists’ terms: In substantial part, prices are determined by endogenous effects peculiar to the inner workings of the markets themselves, rather than solely by the exogenous action of outside events.”1

The market exists at the intersection of a vast number of participants, each with their own evaluations, motivations and specific needs. The emergent complexity makes for routine surprises and inexplicable gyrations. While many times a credibly sounding and easily understood rationale is identified after the fact (ex-post), our ability to precisely identify causes and effects ahead of the moment (ex-ante) remains elusive.

Complex means non-compliant to expectation

Brenda Zimmerman of York University and Sholom Glouberman of the University of Toronto, professors who study the science of complexity, have proposed a distinction among three different kinds of problems in the world: the simple, the complicated, and the complex. Simple problems have neatly consistent logical processes, like baking cake from a mix. Following the recipe brings a high likelihood of success. Complicated problems require a multitude of people, props and specialised expertise to solve – like sending a rocket to the moon. Timing and coordination become vital to success. Complex problems are often unique, and while experience may provide expertise, it does not guarantee success. An example of a complex problem is raising a child. A key feature of complex problems is that their outcomes remain uncertain (probabilistic at best).

Money management probably lies on the spectrum between a complicated and a complex problem. While there is no handy step-by-step guide for confronting complexity, it may be helpful keeping the following general ideas in mind:

Firstly, while complex problems at not linear, they often embed trade-offs. Trade-offs invariably mean conceding something for something else. In the money management business, the trade-offs are well known and run along the lines of potential return against the risk of loss. What makes it complex is that outcomes cannot be known ahead of time.

Next, a key part to dealing with complexity is deciding what is important and what isn’t – it makes the task of weighing up trade-offs more concrete. Often solutions to complex problems benefit from constraints – what are the non-negotiables, for instance.

Finally, accept what is likely in your frame of understanding and what is not. Like the unrequited expectations of many market pundits during the pandemic, the market never quite complies with our expectations – at least not over a short time horizon. The more accepting we are of the complexity of the market, the better able to identify and optimise for those elements that are in our influence.

If we are to learn anything from 2020, we should learn that the world is still complex.

Afterword

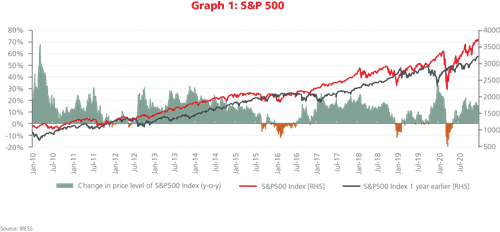

For readers interested in a longer-term view of the S&P 500’s annual price change, Graph 2 illustrates the time series over the past decade. In the last 10 years (or 2,870 trading days), the Index traded below its level from a year earlier for 295 days (or 10% of the time). The events of 2020 did little to alter the trajectory of this market, but it has been a more tumultuous year than we’ve become used to.

For more information or to invest with Prudential, please contact our Client Services Team on 0860 105 775 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter